Trump’s “Big Beautiful” Bill Nears Approval: What It Means for You

House Republicans are

edging ever closer

to getting

President Donald Trump’s “large, magnificent wall”

by crossing the threshold through persuading Republican skeptics.

Lawmakers in the House

Republican

The caucus has been arguing about the future of their budget reconciliation package as Speaker Mike Johnson stated he wants a final vote to occur on Wednesday.

President Trump’s ‘single, grand, impressive bill’ will necessitate a significant endorsement,” Johnson stated. “We are determined to make this happen.

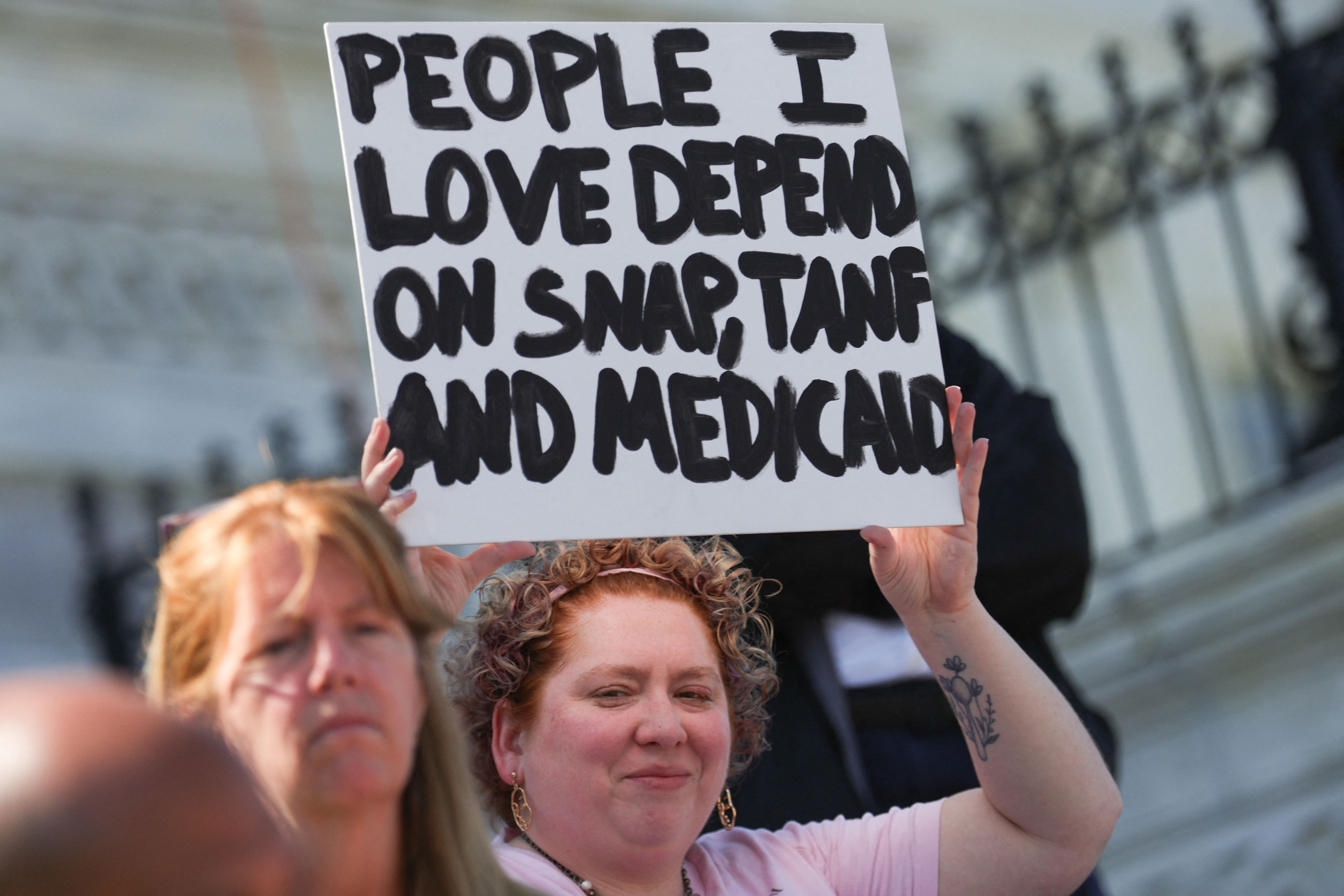

The legislation aims to reduce taxes and boost expenditure on oil extraction, defense, and border protection. It would also involve reductions in funding for Medicaid and food support initiatives.

This is a pivotal moment for the president and his party, as they have staked significant political capital during Trump’s initial months back in the White House on this legislation. The timing is particularly critical due to the substantial economic uncertainties currently facing the nation.

The Democratic leader, Hakeem Jeffries, stated that Republicans are attempting to “swiftly push this widely disliked legislation through the House, as they realize that delaying would expose more details about this harsh and reprehensible bill.”

The proposed bill suggests implementing $1.5 trillion in spending reductions to enable $4.5 billion in tax cuts. If Republicans

failed to locate $2 trillion worth of savings

The remaining funds available for tax reductions would decrease by the amount that lies between $2 trillion and the ultimate figure determined for spending cuts.

The nonpartisan Congressional Budget Office has cautioned that the plan would lead to an additional $3.8 trillion in the federal deficit.

Should the Republican-controlled House align itself with the president, the bill would then be sent to the Senate.

Who benefits the most from Trump’s spending bill?

Initial assessment from the Congressional Budget Office

discovered that the legislation would boost advantages for individuals with the highest incomes by prolonging the 2017 Republican tax proposal.

The agency predicts that “these alterations will not be uniformly spread across all households.” Generally speaking, families at the bottom tenth percentile of income levels would see their resources decline, whereas those at the top tenth percentile can expect an upsurge in their resources.

Although U.S. families could benefit from reduced taxes, the legislation “favors wealthy Americans,” according to Martha Gimbel, who serves as the executive director and co-founder of the Yale Budget Lab.

USA Today

.

“It isn’t significant whether individuals at the lower end receive modest tax reductions if they are losing their healthcare, seeing their SNAP benefits cut, and facing higher tariff costs,” Gimbel stated.

How is Medicaid affected?

More than 70 million Americans on lower incomes rely on Medicaid for almost free health care. The

suggested reductions by the House Republicans

would experience a decrease in federal funding of almost $700 billion over the coming ten years, according to the Congressional Budget Office.

The agency projected that the plans would decrease the number of individuals receiving healthcare by at least 7.6 million due to modifications in Medicaid, and potentially even more if additional alterations were made to the Affordable Care Act.

Trump warned House Republicans not to “f*** around” with Medicaid.

The proposal outlines several modifications needed to be eligible for Medicaid. Under Trump’s legislation, able-bodied adults who do not have children or dependents must commit to working at least 80 hours per month, participating in 80 hours of community service, enrolling in 80 hours of education programs, or combining some of these activities. Additionally, the bill intensifies the frequency of eligibility assessments, leading experts to express concerns that this could result in numerous Americans losing their benefits due to bureaucratic hurdles and administrative complications.

Certain individuals would be excluded from the work requirements, such as those under 19 and over 64 years old, expectant mothers, former foster children up to 26 years old, persons with disabilities, members of Native American tribes, and individuals who are already meeting the employment criteria set forth by the Temporary Assistance for Needy Families program or the Supplemental Nutrition Assistance Program.

The legislation also features a clause aimed at decreasing Medicaid funds for states that utilize their local tax money to offer healthcare coverage to unauthorized immigrants. This plan would predominantly affect so-called Blue states.

The White House stated that the legislation “preserves Medicaid” by “terminating benefits for a minimum of 1.4 million unauthorized immigrants.”

MAGA bank account

Nested within Trump’s extensive 1,116-page appropriations bill is a provision aimed at establishing an automatic tax-favored savings account containing $1,000 for each child born in America, starting from 2025 through the conclusion of 2028.

Although it pays homage to the movement initiated by Trump, its name is an acronym standing for Money Account for Growth and Advancement.

However, financial advisors cautioned that Canadians might find better alternatives for tax-free savings accounts available south of the border, as the new MAGA account includes intricate regulations.

“It’s like, thanks to the government for providing free money, but I’m more concerned with how useful it is,” said Alan Cole, a senior economist at the Tax Foundation.

Yahoo Finance

And honestly, this ranks as the sixth or seventh best choice for a tax-free savings account.

SNAP cuts

Those who get food assistance via the program overseen by the Agriculture Committee

Supplemental Nutritional Assistance Program

, referred to as SNAP, would similarly encounter new work obligations under the proposal.

Specifically, this legislation raises the age at which fit individuals without dependents have to be employed to qualify for food assistance from 54 to 64 years old. This change aligns closely with the period just before numerous people start receiving Social Security and Medicare benefits as senior citizens.

Similarly, this change reduces the age at which children are classified as “dependents” from 18 down to under seven years old. Under this new rule, parents with children aged seven and up would be categorized as able-bodied individuals without dependents, thus necessitating their employment.

“It could very well be one of the most flagrant entries in the entire budget,” Representative Angie Craig from Minnesota, who serves as the ranking Democrat on the Agriculture Committee, stated.

The Independent

What will you do? Simply send parents off to work and leave their seven-year-olds at home? Furthermore, this exclusion clearly disadvantages single parents compared to those who are married.

The Congressional Budget Office stated that approximately 3 million individuals per month would lose their SNAP benefits.

No tax on tips

The law features a provision for a tax break of up to $25,000.

cash tips for eligible employees working in the food, drink and beauty industries.

Approved by the Senate on Tuesday, the “No Tax on Tips Act” will now proceed to the House for voting. This legislation aims to modify the IRS code so that workers in sectors such as food service, beverages, and personal grooming can receive full tax deductions for all their tip earnings from sources like cash, credit cards, debit cards, and checks.

The bill states that consideration should only be given to gratuities received from patrons or clients pertaining to the subsequent services,

states

The provision, delivery, or service of food or drinks for consumption, where it is common practice for customers to tip the staff who deliver or serve these items.

It also states that those “offering beauty services to customers or clients, where tipping employees for these services is typical,” qualify as eligible.

Following a period of 90 days, should the bill be enacted into law, the Treasury Secretary is required to “issue a list detailing jobs that have historically and customarily received gratuities as of December 31, 2023,” according to the legislation.

However, anyone earning over $160,000 does not qualify for the tax exemption.

SALT cap

The State and Local Taxes limit, referred to as SALT, is a deduction that allows individuals to offset their federal tax liability with a portion of the state and local taxes they have paid.

Discussions regarding the ceiling, which presently stands at $10,000, have been ongoing.

somewhat accountable for the holdup in finalizing Trump’s legislation

as Republicans bickered.

A deal was made on Wednesday to increase the limit to $40,000 over ten years for families with incomes below $500,000.

For high-earning individuals who choose to itemize their deductions rather than opting for the standard deduction, this limit can result in savings amounting to several thousand dollars.

Additional reporting was provided by Eric Garcia. The Associated Press also contributed.

The Independent has consistently maintained a worldwide viewpoint. Rooted in strong foundations of exceptional international journalism and analysis, The Independent now boasts a readership that would have been unimaginable at its launch as a newcomer in the UK media landscape. For the first time since the conclusion of World War II, these independent ideals—pluralism, rational thinking, a forward-thinking social agenda, and global outlook—are facing challenges globally. Despite this, The Independent continues to expand its influence.