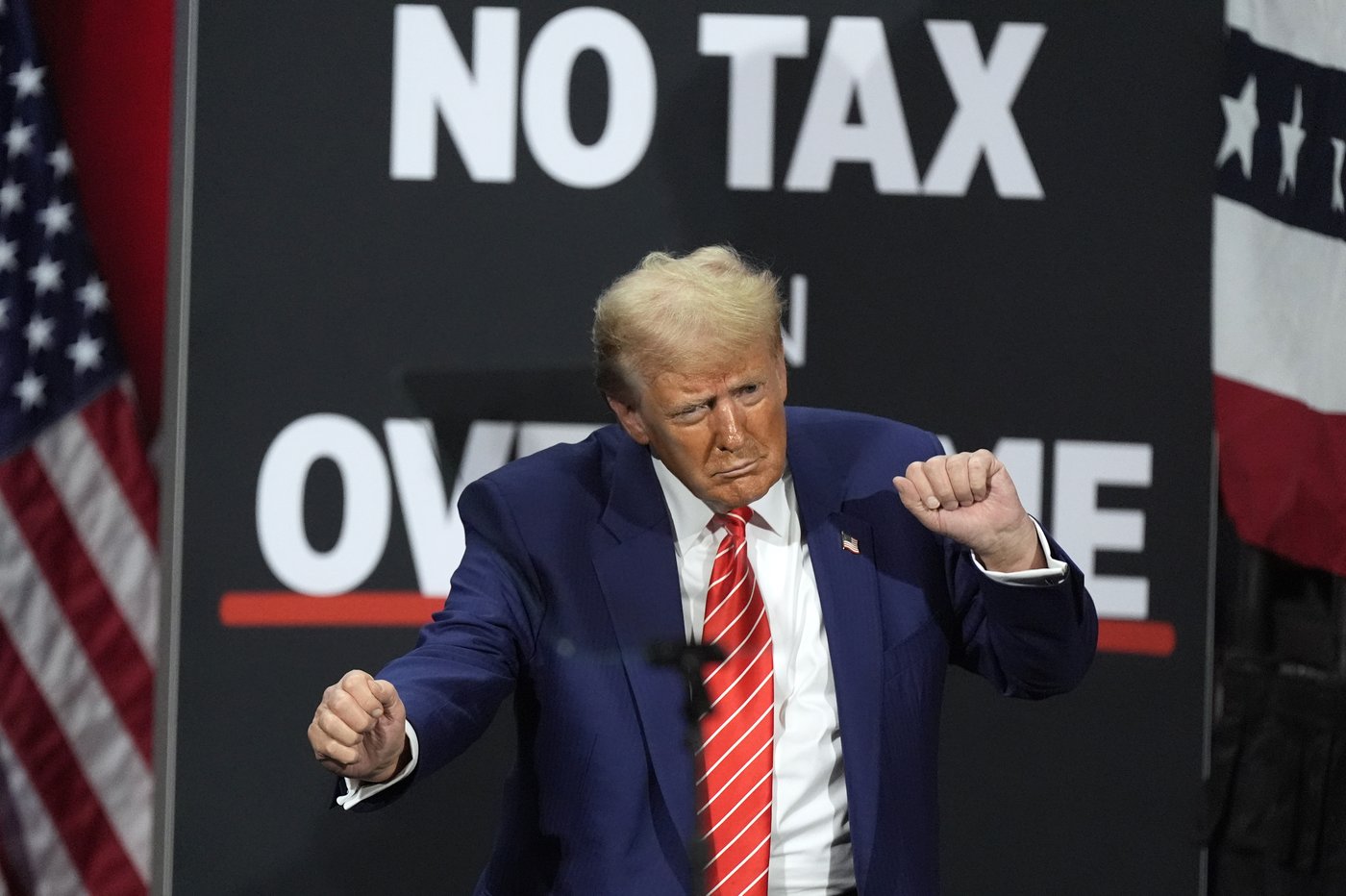

What You Need to Know About Trump’s ‘No Tax on Tips’ Pledge in the GOP Budget Bill

NEW YORK (AP) — President Donald Trump’s

no tax on tips

the pledge has turned into a catchphrase for his 2024 campaign. As it draws nearer, it seems more within reach.

The concept is solidly embedded in the

sprawling tax cuts package

House Republicans

passed early Thursday

And unexpectedly, the Senate voted this week to overwhelmingly support the proposal.

The proposal has widespread support from the public, lawmakers in both parties and employers who believe such a law will bring relief to the working class. But many critics say that it would come with an enormous cost to the government while doing little to help the workers who need it most.

Let’s examine the proposal along with its possible effects:

What does the ‘No Tax on Tips’ clause entail?

This proposal introduces a new tax break, exempting from federal income tax any tips earned by individuals in certain professions who typically receive such gratuities, provided their total earnings do not exceed $160,000 in 2025. Under this plan, the Trump administration has committed to issuing an official list of eligible job categories within three months following the enactment of the legislation.

Only the tips communicated to the employer and documented on an employee’s W-2, their year-end tax statement, would count. payroll taxes, which fund Social Security and Medicare, would continue to be collected alongside state and local taxes.

Should it be implemented, the suggested tax break will lapse after four years according to current plans. Analysts from Congress estimate this measure could lead to an additional $40 billion in deficits by 2028. An advocacy organization named the Committee for a Responsible Federal Budget forecasts that making the tip exception permanent would result in expenses totaling around $120 billion over ten years.

During his campaign, what did Trump state regarding federal taxes on gratuities?

Trump gave this assurance during a

stop during the campaign in Las Vegas

, where the service industry propels economic growth, as part of his appeal to working-class constituents facing increasing expenses.

Parts of his supporter base enthusiastically shared the message, jotting down the slogan on their dining bills or discussing it with their hairdressers during a haircut.

Trump provided minimal information initially, but later elaborated on it.

similar pledges

to remove taxes from various types of income, such as

overtime wages

And Social Security payments. These proposals, alongside a deduction for car loan interest, are part of the Republican Party’s budget proposal.

“No taxes apply to gratuities” was

later embraced

—with restrictions—by the prominent Culinary Union, which represents hospitality employees on the Las Vegas Strip, Nevada’s Democratic senators, and Vice President Kamala Harris, who is Trump’s Democratic opponent.

What effects might this have on employees?

Specialists indicate that certain middle-income service employees might gain from a reduction in taxes, yet they caution that this move could exacerbate inequalities.

“If helping the most impoverished service employees is your objective, this approach is likely not suitable,” stated Michael Lynn, a professor specializing in service marketing at Cornell University, whose work primarily centers around tipping and various aspects of consumer conduct.

Approximately one-third of workers who receive tips earn less than what would require them to pay income tax. These employees won’t experience any savings from this change; therefore, the advantages will primarily benefit those tipped workers who have higher earnings, according to Lynn.

“It’s neglecting non-tipped employees who require assistance equally, and primarily providing this advantage to the most well-off among tipped workers,” Lynn stated.

The median age of tipped employees stands at 31 years old, which is about ten years younger compared to their non-tipped counterparts. Additionally, these individuals typically earn less money, as reported by the Yale Budget Lab.

For tipped employees who earn sufficient income to incur taxes, the typical tax reduction would amount to roughly $1,800, as estimated by the Urban-Brookings Tax Policy Center.

The measure also

might prove difficult to implement

.

What do employers say?

The National Restaurant Association is among industry groups that have been strong backers of a “No Tax on Tips” provision. When reached for comment Wednesday, a spokesperson pointed The Associated Press to a previous statement following the legislation’s introduction in January.

“Removing taxes from tips would return money to many employees within the restaurant and foodservice sector, which might assist businesses in hiring staff,” stated Sean Kennedy, executive vice president of public affairs for the organization, at the time—referring to the No Tax on Tips Act as “practical legislation.” He added that this act contains “financially prudent” safeguards.

In Nevada, the Culinary Workers Union particularly acknowledged that the state’s two Democratic senators, Catherine Cortez Masto and Jacky Rosen, collaborated with Republicans to advance the legislation—urging the House to “make this happen for working families.” This union represents approximately 60,000 hospitality employees statewide, such as bartenders, food servers, and cocktail waitresses who depend on gratuities.

However, other organizations advocating for workers echoed criticisms of the bill.

One Fair Wage, an organization comprising roughly 300,000 service employees and more than 1,000 restaurant owners advocating for higher minimum wages, stated that this proposal provides “some moderate assistance” yet forms part of a taxation plan that primarily benefits the wealthiest individuals while neglecting most people.

“For all the bicameral acclaim…this legislation serves as a diversion from the genuine battle,” said Saru Jayaraman, president of One Fair Wage, emphasizing once more that it’s crucial to increase the minimum wage. The organization additionally advocates for eliminating tip credits, which permit reduced base salaries for tipped employees across numerous states.

______

Cooper reported from Phoenix. Associated Press writer Rio Yamat provided additional reporting from Las Vegas.

Wyatte Grantham-Phillips and Jonathan J. Cooper from The Associated Press